For now, the conditions are perfect for home buyers with a lot more choices, improving mortgage rates, and a slower pace than prior years, yet that is not the forecast down the road.

Now is a Great Time to Buy

Mortgage rates do not need to improve much for a wave of buyer activity to develop quickly.

The phrase “the calm before the storm” dates back to the 17th century when sailors observed how the air and the sea became unusually calm right before stormy weather started. The winds stopped howling, and the waves diminished. Today, the phrase calls attention to a period of quiet or stillness before something significant changes.

Today’s housing market pace is the “calm before the storm.” After years of a brisk, instantaneous speed, Orange County housing is much more balanced. The active inventory has blossomed. More homes are coming on the market, and they have accumulated since the spring of last year. Home buyer demand has been subdued since mortgage rates spiked higher in 2022, eroding home affordability. Pairing the increased supply with low buyer demand has resulted in longer market times and fewer multiple-offer situations. It is the best time to be a buyer in spring since 2019.

While it may be a great time to be a buyer, that does not mean collapsing values. In fact, according to the Freddie Mac Home Price Index, the Los Angeles/Orange County metro has grown by 5% year-over-year through January and up 0.5% month-over-month.

For now, the conditions are excellent for home buyers. It is the best market in years. Yet, it is crucial to understand that right now is the calm before the storm. Down the road, a foreseen wave of buyer activity will result in a substantially hotter housing market than what everyone is experiencing today.

It is best to look at supply and demand to understand how the market can change suddenly. Everyone talks about how the U.S. housing supply has grown considerably since last year. According to the National Association of REALTORS®, the inventory has averaged 1,137,000 since 2021. The U.S. housing market has endured a chronically low inventory and supply scarcity. In January, it was at 1,180,000, up 17% year-over-year. Yet, it is far below where it was before the pandemic. Between 2012 and 2019, the inventory averaged 1,980,833, slowly declining from year to year (white arrow). From 2006 through 2011, during the Great Recession, the inventory averaged 3,347,500. The housing market experienced a supply glut, 184% more homes than today, nearly triple. Since the latter half of 2022, when rates skyrocketed higher and home affordability collapsed, demand dropped to Great Recession levels and has remained there. Home values have not collapsed because low demand is contrasted with a low supply.

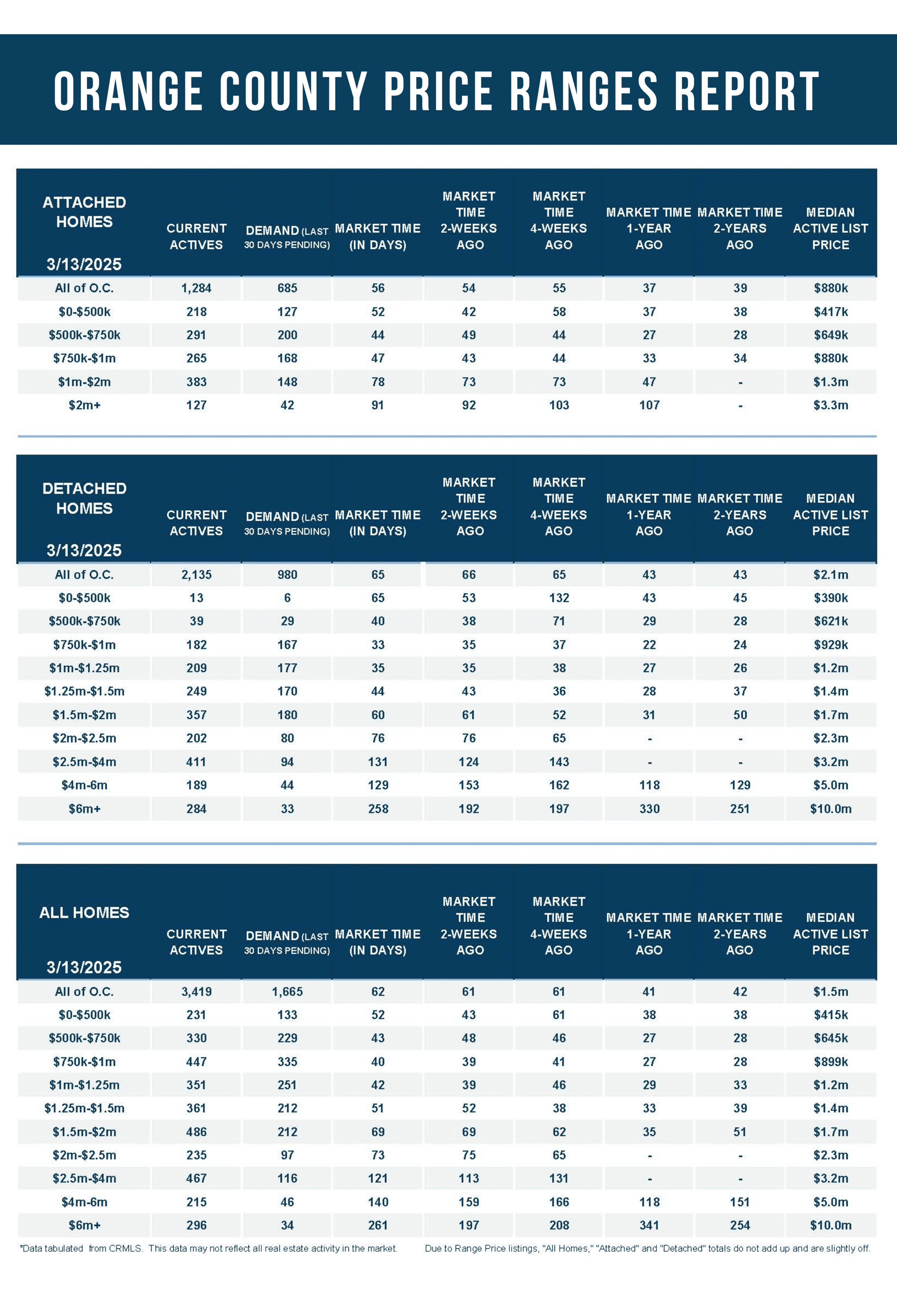

In Orange County, there are only 3,419 homes available to purchase today, up 64% compared to last year’s 2,084 ultra-low inventory. The 3-year average before COVID (2017 to 2019) was 5,286, 55% higher than today, or an extra 1,867 homes, and home values were still appreciating from year to year. The inventory has grown because of an accumulation of extra homes coming on the market. Homeowners have been unwilling to move and give up their underlying low fixed-rate mortgage. In 2023, 41% fewer homes came on the market compared to the 3-year pre-pandemic average. In 2024, it fell to 31%. So far in 2025, it’s off by only 20%. The inventory will continue to grow as more homes accumulate on the market and rates remain close to 7%.

Orange County demand (a snapshot of the number of new pending sales over the prior month) has been hovering at low, anemic levels since the summer of 2022. Today’s demand is at 1,665 pending sales, 8% higher than last year’s 1,538 pending sales. The 3-year average before COVID was 2,517, 51% higher than today, or an extra 852 pending sales.

Expected Market Time, the velocity of the market, is based on supply and demand. Today’s Expected Market Time (the number of days to sell all Orange County listings at the current buying pace) is 62 days, much higher than last year’s 41 days. This is the slowest mid-March reading since 2019 when the housing pace felt “normal”.

The foreseen wave will come when mortgage rates drop towards 6%. The U.S. economy will eventually slow. With increased unemployment, fewer jobs created, lagging retail, and a slowing GDP, mortgage rates ease. Since February 19th, there have already been a series of economic numbers that have started pointing to an economic slower patch. According to Mortgage News Daily, mortgage rates have improved from 7.13% in February to 6.8% today. Eventually, as the economy slows, rates will drop to 6%, matching September 2024 levels. A buyer's purchasing power improves dramatically as mortgage rates fall.

If a buyer desires a monthly payment of $5,000 (principal and interest with 20% down), at 7%, they would be looking to purchase a $940,000 home. At 6%, they could buy a $1,042,500 home. When rates fall, it will open up a floodgate of demand, pent-up potential buyers waiting on the sideline to purchase due to affordability constraints.

In 2024, for 47 days, from August 20th through October 3rd, rates dropped below 6.5%. You could see the significant impact on demand. It jumped 10% at the end of September and remained elevated through the end of the year. This was just a tiny glimpse of the future foreseen wave of buyer activity. Millennials and Generation Z have been eagerly waiting for mortgage rates to fall and for home affordability to improve so that they can purchase a home. When rates drop and remain close to 6% or lower for a long duration, buyer demand will rise, and the housing market will grow much hotter, the number of multiple offers will increase, bidding wars will reemerge in the entry-level price range, and home values will rise. The lower rates fall, the larger the wave of activity.

Today’s market is much slower, a calmer pace for buyers. Yet, it is the calm before the storm. Eventually, as the economy cools, mortgage rates will fall, and the foreseen wave of buyer activity will materialize rapidly.

Active Listings

The inventory grew by 7% in the past couple of weeks.

The active listing inventory increased by 236 homes in the past two weeks, up 7%, and now sits at 3,419. Generally, at this time of year, the inventory grows by 3%. The Spring Market has arrived, when more homes come on the market, and demand slowly rises until it peaks between April and May. May is when the most homes come on the market. The number of homes coming on the market remains at a heightened level from March through August. With more homes coming on the market this year compared to the last couple of years, these extra homes will continue to accumulate, and the active listing inventory will grow at a faster pace than what is typical. This will continue until rates drop below 6.5%. Until then, there just is not enough demand to absorb the extra homes.

Last year, the inventory was at 2,084 homes, 39% lower, or 1,335 fewer. The 3-year average before COVID (2017 through 2019) was 5,286, an additional 1,867 homes, or 55% more.

Homeowners continue to “hunker down” in their homes, unwilling to move due to their current underlying, locked-in, low fixed-rate mortgage. It became a crisis once rates skyrocketed higher in 2022. For February, 2,459 new sellers entered the market in Orange County, 673 fewer than the 3-year average before COVID (2017 to 2019), 21% less. Last February, there were 2,065 new sellers, 16% fewer than this year. More sellers are opting to sell compared to the previous couple of years.

Demand

Demand grew by 6% in the past couple of weeks.

Demand, a snapshot of the number of new pending sales over the prior month, increased from 1,569 to 1,665 in the past couple of weeks, up 96 pending sales, or 6%, its highest level since last May. Mortgage rates were stuck above 7% from December 18th through February 19th. With the U.S. economy beginning to slow, rates dropped below 7% and remained there. This aligns perfectly with the Spring Market, the busiest time of the year in terms of buyer demand. Last year, at this time, rates were at 7.11% and remained above 7% for most of the Spring and Summer Markets, which diminished potential buyer demand. The lower rates drop, the more buyer activity will improve and demand levels will rise. Demand is currently 8% higher than last year.

As the Federal Reserve has indicated, watching all economic releases for signs of slowing is essential. That is the only path to lower mortgage rates right now. These releases can move mortgage rates higher or lower, depending on how they compare to market expectations. This week, the Federal Reserve meets and will conduct a press conference to announce their decision on the Federal Funds rate, and they will ultimately reveal their appetite to cut rates in the near future and into 2025. Next week, the Personal Consumption Expenditures – Price Index (PCE), the Fed’s preferred inflation gauge, will be released on Friday. It will be a pivotal two weeks for mortgage rates.

Last year, demand was 1,538, with 127 fewer pending sales or 8% less. The 3-year average before COVID (2017 to 2019) was 2,517 pending sales, 51% more than today, or an additional 852.

With supply rising slightly faster than demand, the Expected Market Time (the number of days it takes to sell all Orange County listings at the current buying pace) increased from 61 to 62 days in the past couple of weeks. Last year, it was 41 days, noticeably faster than today. The 3-year average before COVID was 63 days, similar to today.

Luxury End

The luxury market slowed in the past couple of weeks.

The luxury inventory of homes priced above $2.5 million (the top 10% of the Orange County housing market) increased from 939 to 978 homes, up 39 or 4%. Luxury demand decreased by four pending sales, down 2%, and now sits at 196. The Expected Market Time for luxury homes priced above $2.5 million increased from 141 to 150 days. Wall Street’s volatility is beginning to seep into the luxury market.

In the past two weeks, the Expected Market Time for homes priced between $2.5 million and $4 million increased from 113 to 121 days. For homes priced between $4 million and $6 million, the Expected Market Time decreased from 159 to 140 days. For homes priced above $6 million, the Expected Market Time increased from 197 to 261 days. At 261 days, a seller would be looking at placing their home into escrow around December 2025.

Orange County Housing Summary

- The active listing inventory in the past couple of weeks increased by 236 homes, up 7%, and now sits at 3,419. In February, 21% fewer homes came on the market compared to the 3-year average before COVID (2017 to 2019), 673 less. Yet 394 more sellers came on the market this February compared to February 2024. Last year, there were 2,084 homes on the market, 1,335 fewer homes, or 39% less. The 3-year average before COVID (2017 to 2019) was 5,286, or 55% extra.

- Demand, the number of pending sales over the prior month, increased by 96 pending sales in the past two weeks, up 6%, and now totals 1,665, its highest level since last May. Last year, there were 1,538 pending sales, 8% less. The 3-year average before COVID (2017 to 2019) was 2,517, or 51% more.

- With supply rising slightly faster than demand, the Expected Market Time, the number of days to sell all Orange County listings at the current buying pace, increased from 61 to 62 days in the past couple of weeks. Last year, it was 41 days, substantially faster than today. The 3-year average before COVID (2017 to 2019) was 63 days, similar to today.

- In the past two weeks, the Expected Market Time for homes priced below $750,000 remained unchanged at 46 days. This range represents 16% of the active inventory and 22% of demand.

- The Expected Market Time for homes priced between $750,000 and $1 million increased from 39 to 40 days. This range represents 13% of the active inventory and 20% of demand.

- The Expected Market Time for homes priced between $1 million and $1.25 million increased from 39 to 42 days. This range represents 10% of the active inventory and 15% of demand.

- The Expected Market Time for homes priced between $1.25 million and $1.5 million decreased from 52 to 51 days. This range represents 11% of the active inventory and 13% of demand.

- The Expected Market Time for homes priced between $1.5 million and $2 million remained unchanged at 69 days. This range represents 14% of the active inventory and 12% of demand.

- The Expected Market Time for homes priced between $2 million and $2.5 million decreased from 75 to 73 days. This range represents 7% of the active inventory and 6% of demand.

- In the past two weeks, the Expected Market Time for homes priced between $2.5 million and $4 million increased from 113 to 121 days. For homes priced between $4 million and $6 million, the Expected Market Time decreased from 159 to 140 days. For homes priced above $6 million, the Expected Market Time increased from 197 to 261 days.

- The luxury end, all homes above $2 million, accounts for 29% of the inventory and 12% of demand.

- Distressed homes, both short sales and foreclosures combined, comprised only 0.1% of all listings and 0.3% of demand. Only two foreclosures and two short sales are available today in Orange County, with four total distressed homes on the active market, down one from two weeks ago. Last year, five distressed homes were on the market, similar to today.

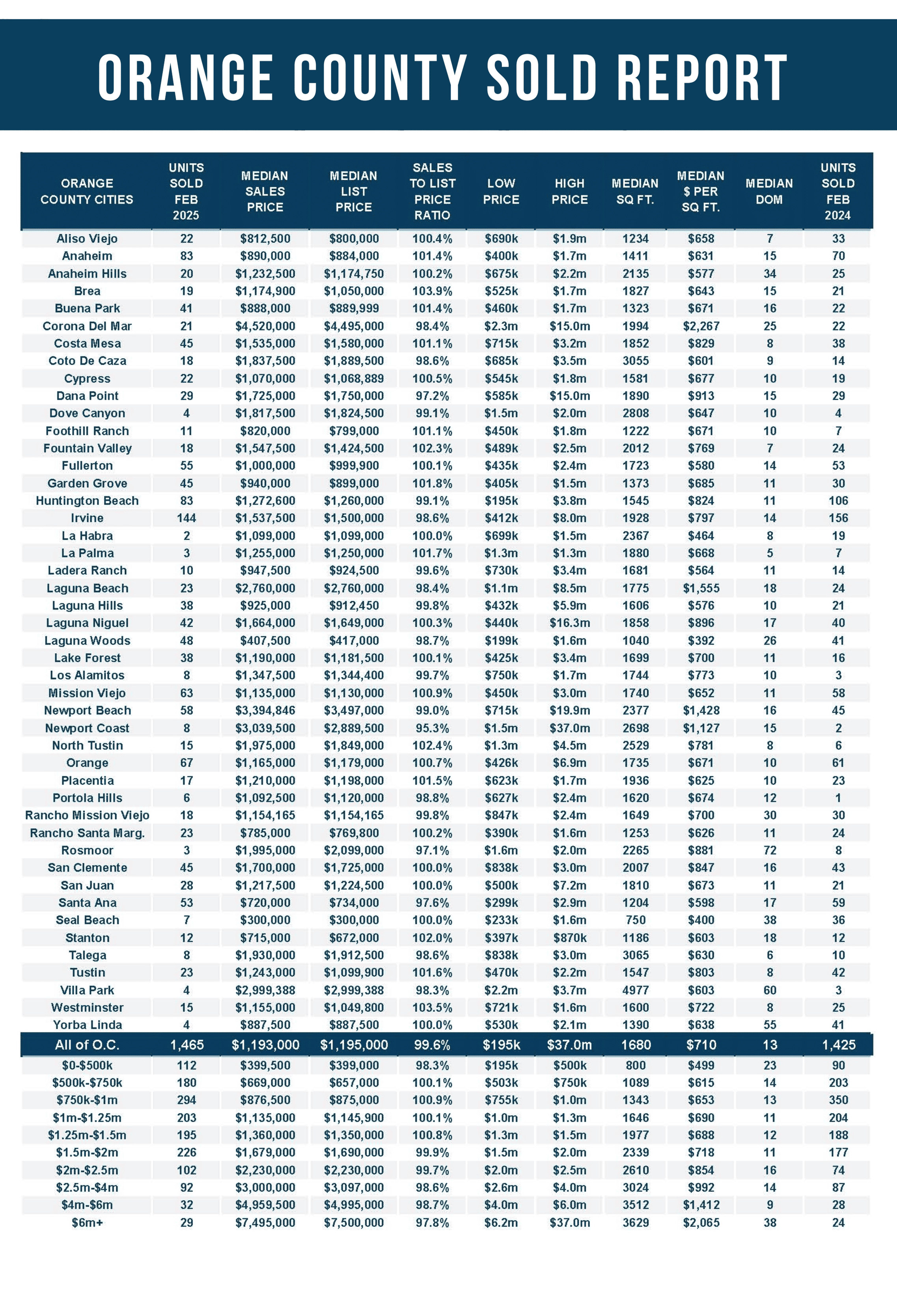

- There were 1,465 closed residential resales in February, up 3% compared to February 2024’s 1,425 and up 16% from January 2025. The sales-to-list price ratio was 99.6% for Orange County. Foreclosures accounted for 0.1% of all closed sales, and Short sales accounted for 0.3%. That means that 99.6% of all sales were good ol’ fashioned sellers with equity.